If you’re wondering how to file taxes while living abroad, then I highly recommend Taxes for Expats. You probably have questions like, “How do I file US taxes from abroad?” Luckily for us, Taxes for Expats has been preparing expat returns for over 25 years for clients in 175 countries. Living abroad is a fun adventure, but Uncle Sam always calls for his dues every year without fail. This guide is designed to help you file a US tax return from abroad.

Table of Contents

Blog Posts You Might Like

- A Complete Guide to Solo Female Travel in Korea

- How To Get a Job Teaching English in Korea

- How To Study Korean With 90 Day Korean

- The Ultimate Guide For Expat Women in Korea

- What’s It Really Like Living in South Korea?

Frequently Asked Questions

Do American expats living abroad still have to pay US taxes?

When I first moved to Japan in 2012, I was tax exempt from both the US and Japan for two years. This is an agreement between the countries. Then again when I moved to South Korea, I was tax exempt from the US for two years based on their agreement.

I had to file paperwork with the US Department of Treasury that had my social security number on it and declared I was a tax payer of the United States in order to be exempt.

Depending on where you live abroad, it’s a case by case scenario.

According to the IRS, American citizens and resident aliens living abroad are still subject to US taxation based on worldwide income, even if you live overseas.

What is the due date of a US tax return?

When you file taxes living abroad, you automatically get a two month extension. Most American citizens must file their taxes by April 15th of each year. To file taxes online abroad the date automatically gets extended to June 15th.

What is the due date of a US tax return in 2020?

Due to the corona virus epidemic plaguing the United States at the moment, expats living abroad can have an extension. The new date to file your taxes by will be October 15, 2020.

Important Tax Dates For Americans

- April 15 – This is the deadline for all American citizens and resident aliens residing in the US. If you’re living abroad, you must pay any taxes due by April 15th to avoid interest and penalties even if you are using the June 15th extension date.

- June 15 – Most American citizens abroad automatically qualify for a 2-month extension to file their US tax return. If you qualify for the 2-month extension, penalties for paying any tax late are assessed from the extended due date of the payment.

- October 15 – You can request an additional 4-month extension from June 15 if you automatically qualify for the 2-month extension. You will need to use Form 4868. File the extension before your 2 month extension is up.

Double Taxation

One of the things most expats are worried about is double taxation. What a nightmare to have to pay taxes to your host country and your home country. Luckily, there are rules and regulations set in place to prevent double taxation.

- You can exclude your foreign earned income from US taxation.

- You can use the foreign income tax which you paid abroad as a tax credit against the US taxes owed.

- You can exclude other income types from US taxation using a valid tax treaty.

Taxes For Expats Review

What is Taxes for Expats? They are a services that focuses specifically on helping expatriates living abroad to file their taxes easily and efficiently. They accredited by the Better Business Bureau and are a very trustworthy service. Besides I love how it’s owned by women because the future is female. They offer services such as:

- back taxes

- tax planning

- applying for the IRS amnesty program if you have delinquent taxes

- reviewing your self prepared tax form

- helping you file an amended tax return

How To File Taxes When Abroad

In this step-by-step guide, I will teach you how file a US tax return from abroad. I highly recommend using Taxes for Expats. I will show you how to sign up for an account and do a step-by-step process on how to file your taxes using Taxes for Expats.

1. Go To TaxesForExpats.com and sign up for an account.

Use the coupon code 50THANKYOU to get a $50 reduction in their fees. Once you sign up, you will receive an email with instructions that gives you access to your own tax portal.

2. Schedule a free 30 minute tax consultation.

You may be asked to put down a $50 retainer fee, but it will be put toward your final bill.

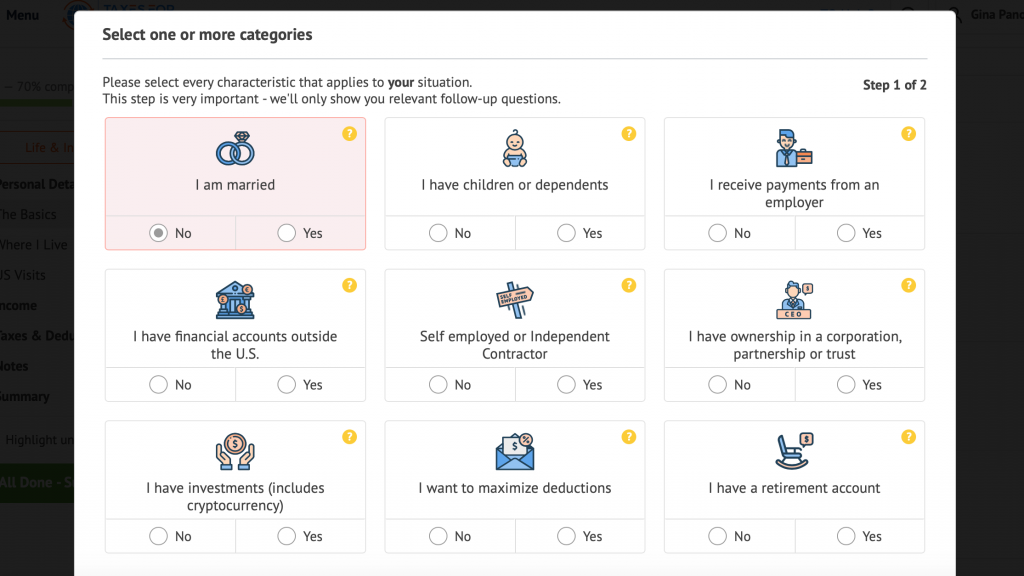

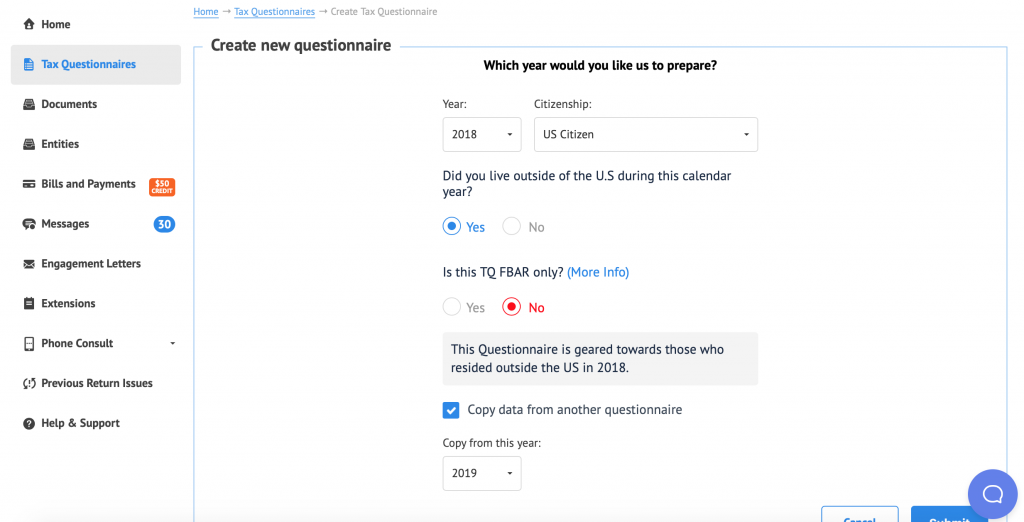

3. Do the tax questionnaire.

You will next login to your portal and fill out the interactive tax questionnaire. Taxes For Expats questionnaire doesn’t require filling out PDFs or Word Documents. Whenever you answer a question, it will update and help you along.

If you don’t understand a question, they have a frequently asked question section. You also have the option to email your tax preparer directly.

All the answers you put into the questionnaire are saved for next year so that way it is a HUGE time saver.

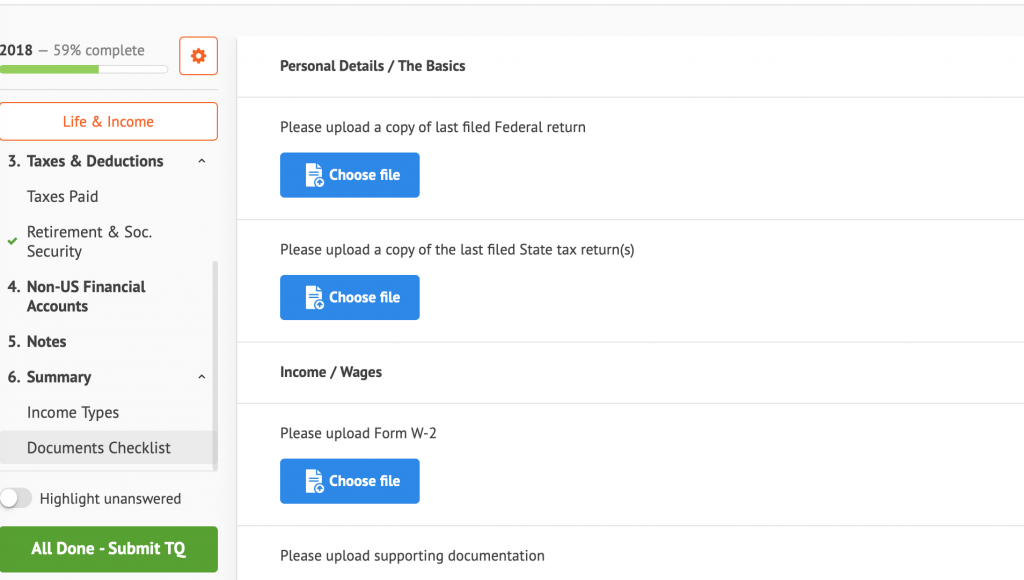

4. Upload Supporting Tax Documents

Based on the questions you answered, you are required to upload all supporting documents.

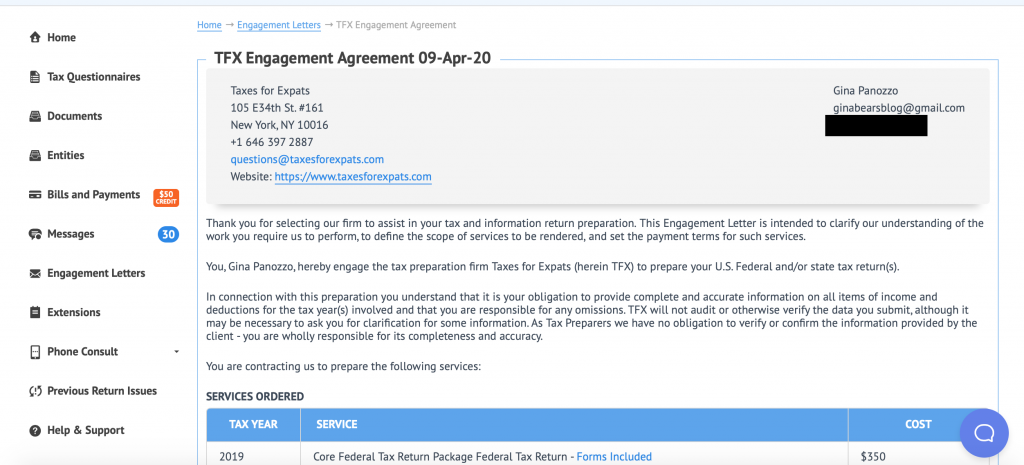

5. Review and sign the Engagement Letter.

6. File Your Tax Return

After you’ve paid for the service and signed the letter, you can choose to download it and mail it to the IRS yourself. Or you can have Taxes For Expats e-file it for you. It’s obviously a no brainer to have them e-file your taxes since we’re busy expats.

Taxes for Expats Pricing

Taxes for Expats has three tiers of packaging to help expats choose which is the best for them. If you click on this link, you will automatically get a $25 discount toward filing your taxes.

- Core Package $350 – This package contains US and Foreign Wages, foreign tax credit form 1116, health care coverage exemption, alternative minimum tax calculations, estimated payment vouchers, gross income below $100K, US retirement and social security income, interest and dividends, foreign earned income exclusion form 2555, child & dependent credits and deductions, and over 30 tax forms included.

- Premier Package $450 – This package includes all the forms in the Core Package plus investment capital gains, 1 rental property, self-employment income, other non-wage income, 1 schedule K-1, earned income credit, non US retirement income, and gross income over $100K.

- Streamlined Procedure Package $1200 – This packages offers 3 years of tax returns from 2015-2017, 6 Years FBAR, $1200 for the Core Package or $1400 for the Premier Package, and access to the special IRS Program.

This post contains affiliate links which means at no additional cost to you, I make a small commission to help keep Gina Bear’s Blog running. Thanks for your support!

Free Seoul E-Book

Do you love South Korea?

Enter your name and email address and click the button below to receive your Easy Seoul Travel Guide so you can travel like a local!